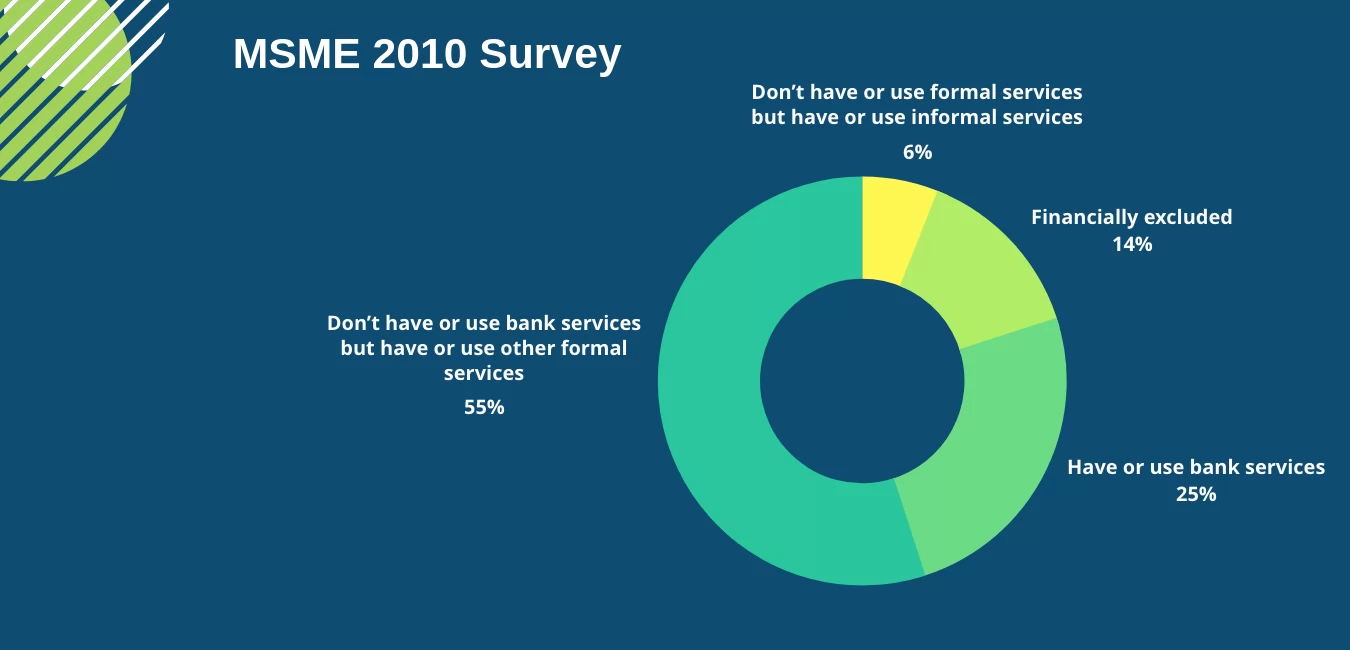

Only 25% of small businesses use formal financial services

The small business sector has the potential to make a significant contribution to the economy of Tanzania. It has the capacity to provide employment, particularly in rural areas which lack economic opportunity, as well as reducing the gender gap, alleviating poverty and generating government revenue through taxation and business license fees.

However, despite ongoing national reform programmes, there remain considerable challenges for Micro, Small and Medium Enterprises (MSMEs). The Ministry of Industries, Trade and Investment highlighted a ‘persistent culture that has not recognised the value of entrepreneurial initiative in improving the lives of the people. Other factors include complex, bureaucratic and costly legal, regulatory and administrative environment where SMEs are at a greater disadvantage than their counterparts that are larger in size”.

Contribute of GDP

Account of employment

Located in rural areas

Are one-person businesses

Of MSMEs are formally registered

Source: FinScope Tanzania and MSME Survey, URT 2016

Challenges

FSDT studies have shown that addressability is not a key issue for the agricultural sector, as the majority of farmers live within 5km of a financial access point and have access to a mobile phone. Although their basic uptake across services has also been increasing, there are opportunities to expand uptake further and to deepen customer usage. Perceptions persist among financial service providers of high risk and low returns for this sector, resulting in few use cases and solutions that meet the needs of agricultural workers.

FSDT studies have shown that addressability is not a key issue for the agricultural sector, as the majority of farmers live within 5km of a financial access point and have access to a mobile phone. Although their basic uptake across services has also been increasing, there are opportunities to expand uptake further and to deepen customer usage. Perceptions persist among financial service providers of high risk and low returns for this sector, resulting in few use cases and solutions that meet the needs of agricultural workers.

For agricultural workers, the benefits of improved access and usage of financial services are considerable, but many face a range of barriers to inclusion:

- A large majority of farmers live in rural areas, reducing their connectivity to a wide range of formal financial products and services

- Very few have completed secondary education and so have low levels of literacy and numeracy, leading to lack of awareness and knowledge of the benefits of financial products and services

- Average income of dedicated farmers is seasonal and over 10% below national average, presenting challenges to meet registration requirements for formal financial services

- Less than half of farmers own land and, among them, the majority do not have proof of ownership, limiting their ability to meet Know-Your-Customer requirements

FSDT’s strategy for enterprises

Multi-stakeholder effort is needed for the small business sector to achieve its potential and make a far greater contribution to the economic growth of the country. On the supply side, policy-makers and financial service providers must understand and address the needs of MSMEs and, on the demand side, business owners should be encouraged to build their knowledge and trust of the financial sector to reap the benefits of financial inclusion for their businesses, families and communities.

Multi-stakeholder effort is needed for the small business sector to achieve its potential and make a far greater contribution to the economic growth of the country. On the supply side, policy-makers and financial service providers must understand and address the needs of MSMEs and, on the demand side, business owners should be encouraged to build their knowledge and trust of the financial sector to reap the benefits of financial inclusion for their businesses, families and communities.

We have been working with the Ministry of Industries, Trade & Investments to develop a framework that will enable coordinated activities for the MSME sector, with specific focus on access and usage of financial services. The objectives of the framework are to achieve 40% GDP contribution, 35% share of employment and 50% access to financial products and services by 2022.